Housing Strains, Asian Frictions and the Rise of Prediction Markets

Northern Trust’s weekly commentary examines three pressure points shaping 2026: U.S. housing affordability, China-Japan trade tensions, and the growing signal from prediction markets

-

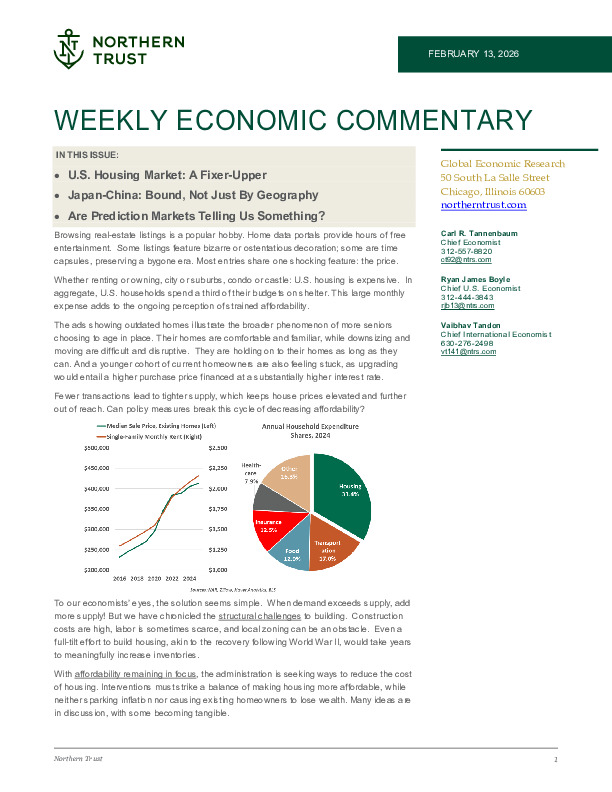

U.S. housing remains constrained by low turnover and structural supply barriers; policy ideas—from GSE MBS purchases to zoning reform—may ease margins but won’t quickly restore affordability.

-

China-Japan tensions carry material trade and supply-chain risks, yet deep economic interdependence reduces the likelihood of full-scale retaliation.

-

Prediction markets are gaining credibility as real-time probability gauges, sometimes outperforming traditional forecasts.

Are these frictions cyclical noise—or early signals of structural change? The full commentary connects the dots.

Registreer of log in om verder te lezen. Investment Officer is een onafhankelijk journalistiek platform voor professionals werkzaam in de Belgische beleggingsindustrie.

Een abonnement is GRATIS voor professionals die werkzaam zijn bij banken en onafhankelijke vermogensbeheerders.