Housing Strains, Asian Frictions and the Rise of Prediction Markets

Northern Trust’s weekly commentary examines three pressure points shaping 2026: U.S. housing affordability, China-Japan trade tensions, and the growing signal from prediction markets

-

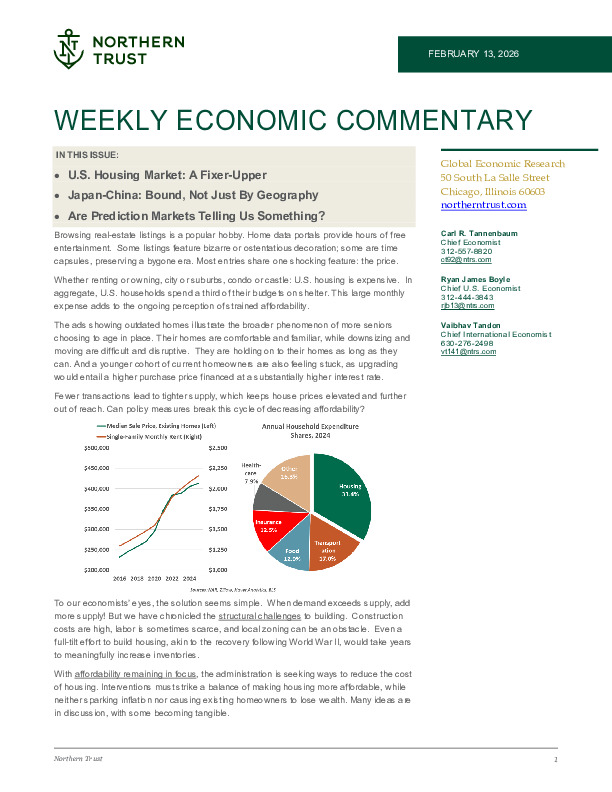

U.S. housing remains constrained by low turnover and structural supply barriers; policy ideas—from GSE MBS purchases to zoning reform—may ease margins but won’t quickly restore affordability.

-

China-Japan tensions carry material trade and supply-chain risks, yet deep economic interdependence reduces the likelihood of full-scale retaliation.

-

Prediction markets are gaining credibility as real-time probability gauges, sometimes outperforming traditional forecasts.

Are these frictions cyclical noise—or early signals of structural change? The full commentary connects the dots.

Enregistrez-vous ou connectez-vous pour lire la suite. Investment Officer est une plateforme journalistique indépendante à destination des professionnels de l’industrie belge des investissements.

L’abonnement est GRATUIT pour les professionnels actifs au sein de banques et gestionnaires d’actifs indépendants.