Crypto Volatility Meets Quantum Risk

In this WisdomTree research note, Elvira Kuramshina and Blake Heimann examine how macro shocks, leverage, and emerging quantum threats are reshaping crypto’s risk profile

-

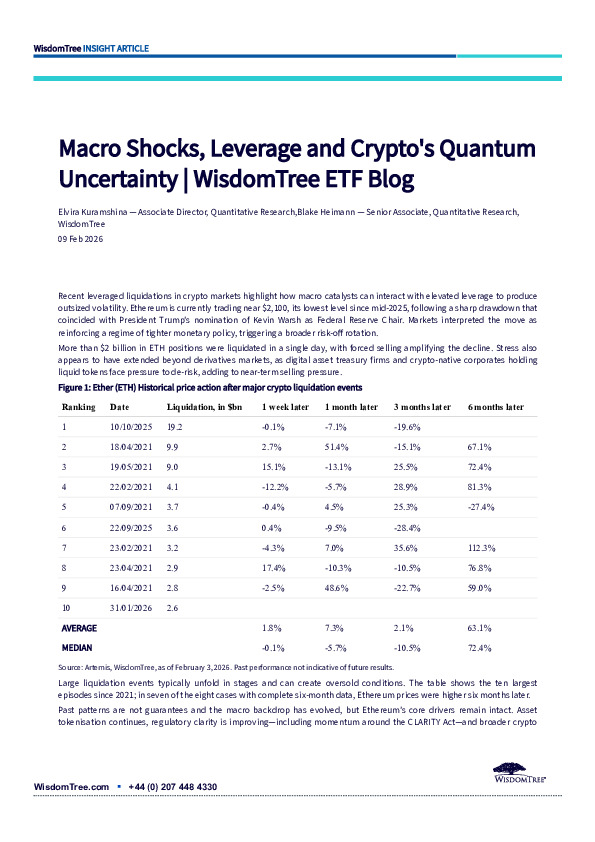

Over $2bn in ETH liquidations followed a hawkish Fed nomination, illustrating how elevated leverage can amplify macro-driven drawdowns; historically, major liquidations have often preceded six-month recoveries.

-

Beyond cyclical volatility, quantum computing poses a structural challenge to current public-key cryptography, accelerating migration toward post-quantum standards.

-

Coordinated regulatory roadmaps in the US and EU suggest quantum resilience is becoming a near-term investment theme, not a distant tail risk.

Are crypto markets discounting a temporary liquidity shock—or a deeper security transition? The full note explores both cyclical and structural implications.

Registreer of log in om verder te lezen. Investment Officer is een onafhankelijk journalistiek platform voor professionals werkzaam in de Belgische beleggingsindustrie.

Een abonnement is GRATIS voor professionals die werkzaam zijn bij banken en onafhankelijke vermogensbeheerders.