Crypto Volatility Meets Quantum Risk

In this WisdomTree research note, Elvira Kuramshina and Blake Heimann examine how macro shocks, leverage, and emerging quantum threats are reshaping crypto’s risk profile

-

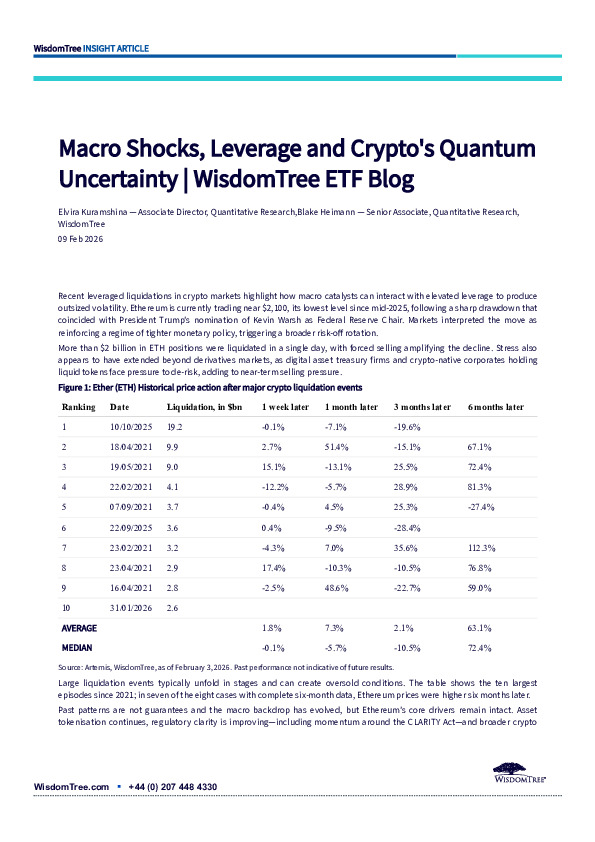

Over $2bn in ETH liquidations followed a hawkish Fed nomination, illustrating how elevated leverage can amplify macro-driven drawdowns; historically, major liquidations have often preceded six-month recoveries.

-

Beyond cyclical volatility, quantum computing poses a structural challenge to current public-key cryptography, accelerating migration toward post-quantum standards.

-

Coordinated regulatory roadmaps in the US and EU suggest quantum resilience is becoming a near-term investment theme, not a distant tail risk.

Are crypto markets discounting a temporary liquidity shock—or a deeper security transition? The full note explores both cyclical and structural implications.

Enregistrez-vous ou connectez-vous pour lire la suite. Investment Officer est une plateforme journalistique indépendante à destination des professionnels de l’industrie belge des investissements.

L’abonnement est GRATUIT pour les professionnels actifs au sein de banques et gestionnaires d’actifs indépendants.