Bond Supply and Tariff Limits Reinforce a Selective Risk-On Stance

BlackRock Investment Institute’s weekly commentary by Jean Boivin, Wei Li, Ben Powell and Michel Dilmanian assesses how market volatility is being tempered by economic constraints and rising leverage.

-

Renewed US tariff threats briefly pushed DM bond yields higher, but policy pullbacks highlighted “immutable laws” such as the US reliance on foreign capital.

-

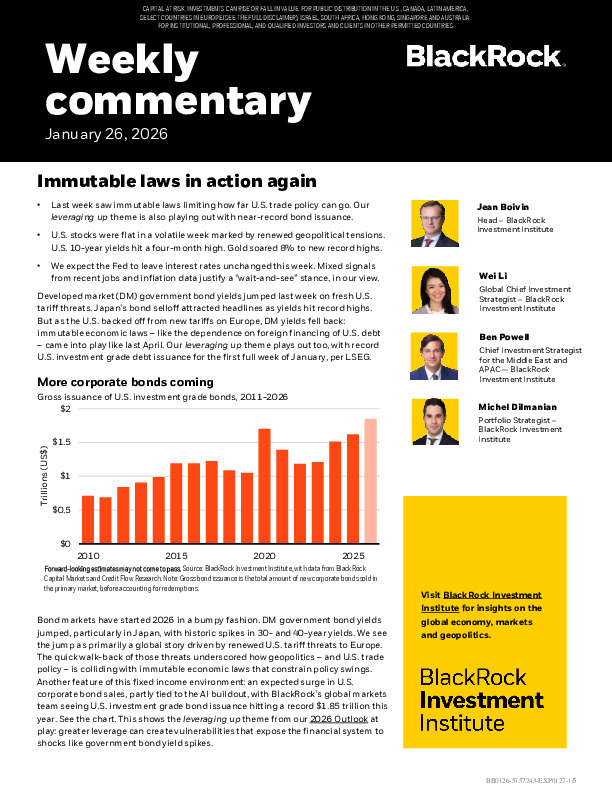

A surge in US investment-grade issuance—linked partly to AI capex—signals rising leverage, increasing sensitivity to yield shocks.

-

With bonds offering less ballast, preferences tilt toward MBS, EM debt and selective credit, while remaining underweight long-duration DM government bonds.

Explore the full commentary for tactical asset views and portfolio construction implications.

Registreer of log in om verder te lezen. Investment Officer is een onafhankelijk journalistiek platform voor professionals werkzaam in de Belgische beleggingsindustrie.

Een abonnement is GRATIS voor professionals die werkzaam zijn bij banken en onafhankelijke vermogensbeheerders.