Bond Supply and Tariff Limits Reinforce a Selective Risk-On Stance

BlackRock Investment Institute’s weekly commentary by Jean Boivin, Wei Li, Ben Powell and Michel Dilmanian assesses how market volatility is being tempered by economic constraints and rising leverage.

-

Renewed US tariff threats briefly pushed DM bond yields higher, but policy pullbacks highlighted “immutable laws” such as the US reliance on foreign capital.

-

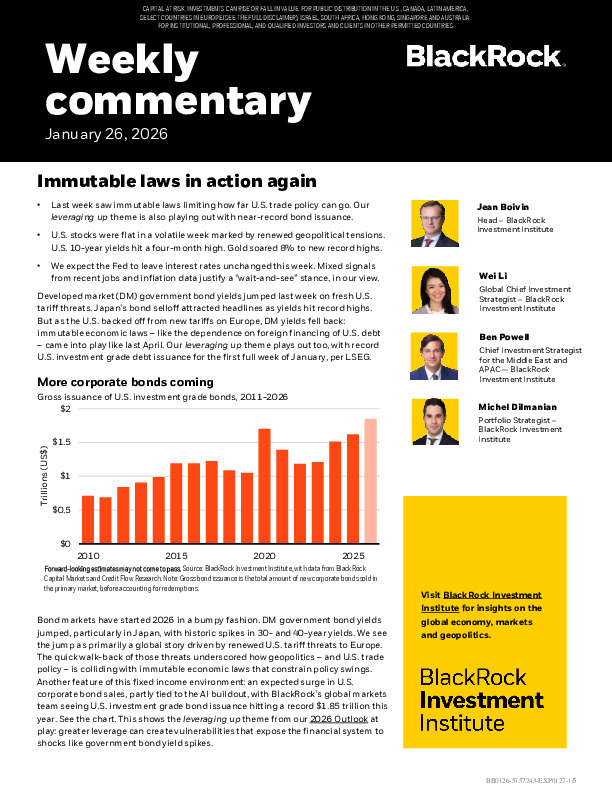

A surge in US investment-grade issuance—linked partly to AI capex—signals rising leverage, increasing sensitivity to yield shocks.

-

With bonds offering less ballast, preferences tilt toward MBS, EM debt and selective credit, while remaining underweight long-duration DM government bonds.

Explore the full commentary for tactical asset views and portfolio construction implications.

Enregistrez-vous ou connectez-vous pour lire la suite. Investment Officer est une plateforme journalistique indépendante à destination des professionnels de l’industrie belge des investissements.

L’abonnement est GRATUIT pour les professionnels actifs au sein de banques et gestionnaires d’actifs indépendants.