Markets content with a 'not too cold' economy

Amundi Investment Institute’s Global Investment Views (February 2026), led by Vincent Mortier, Monica Defend and Philippe d’Orgeval, sets out cross-asset convictions amid resilient growth, easing inflation and rising geopolitical noise.

-

Risk assets remain supported by modest GDP growth and disinflation, allowing central banks to move cautiously and preserve liquidity.

-

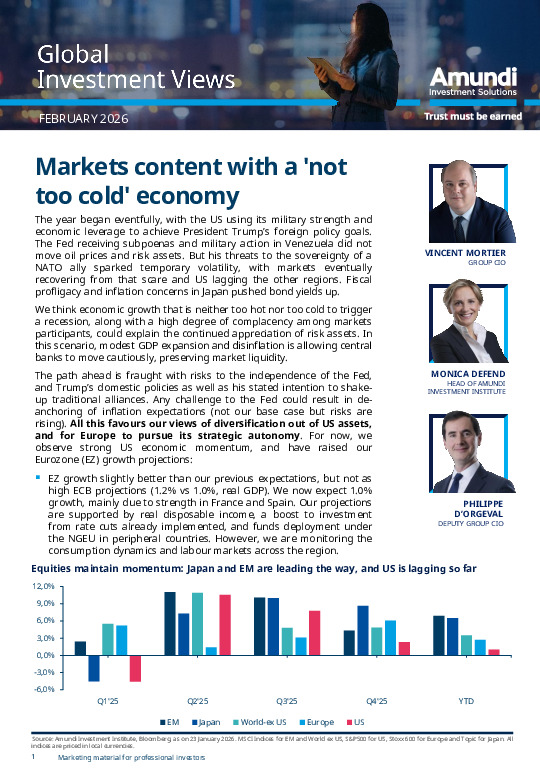

Equities favour Japan and EM on structural reforms and valuations, while US leadership is constrained by concentration and policy risks.

-

Fixed income prioritises carry over duration, with selective opportunities in EU credit, peripherals and EM bonds; gold is upgraded as a stabiliser.

Explore the full views for asset-class positioning, regional preferences and risk-management implications.

Registreer of log in om verder te lezen. Investment Officer is een onafhankelijk journalistiek platform voor professionals werkzaam in de Belgische beleggingsindustrie.

Een abonnement is GRATIS voor professionals die werkzaam zijn bij banken en onafhankelijke vermogensbeheerders.