Markets content with a 'not too cold' economy

Amundi Investment Institute’s Global Investment Views (February 2026), led by Vincent Mortier, Monica Defend and Philippe d’Orgeval, sets out cross-asset convictions amid resilient growth, easing inflation and rising geopolitical noise.

-

Risk assets remain supported by modest GDP growth and disinflation, allowing central banks to move cautiously and preserve liquidity.

-

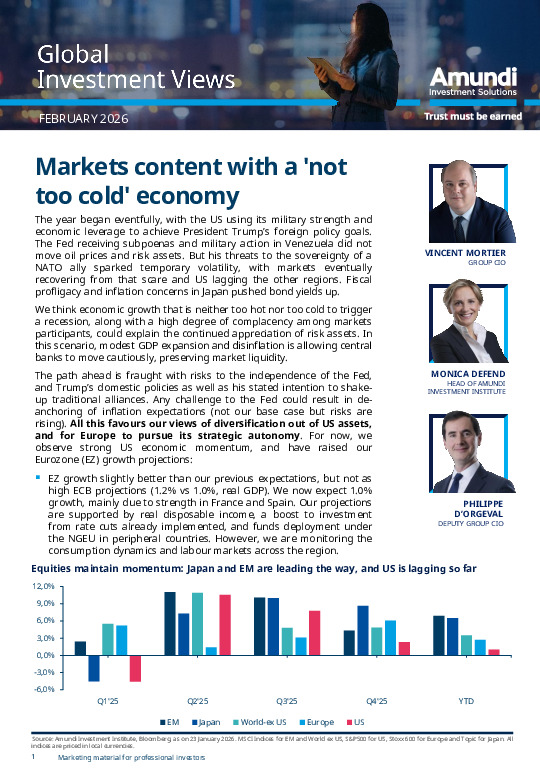

Equities favour Japan and EM on structural reforms and valuations, while US leadership is constrained by concentration and policy risks.

-

Fixed income prioritises carry over duration, with selective opportunities in EU credit, peripherals and EM bonds; gold is upgraded as a stabiliser.

Explore the full views for asset-class positioning, regional preferences and risk-management implications.

Enregistrez-vous ou connectez-vous pour lire la suite. Investment Officer est une plateforme journalistique indépendante à destination des professionnels de l’industrie belge des investissements.

L’abonnement est GRATUIT pour les professionnels actifs au sein de banques et gestionnaires d’actifs indépendants.