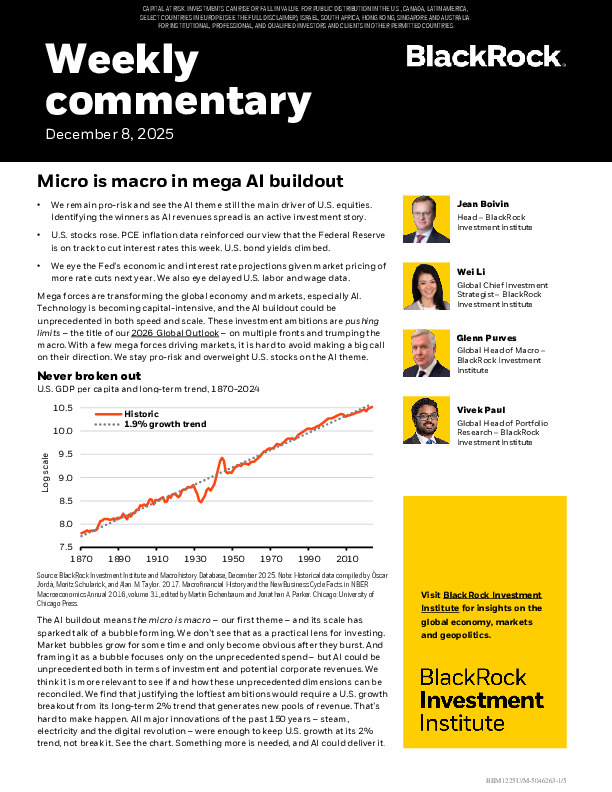

AI’s Buildout Turns Micro Trends Into Macro Forces

BlackRock’s latest commentary frames the AI expansion as a structural engine now shaping market direction, capital flows and investor positioning.

-

The investment surge behind AI is redefining U.S. equity leadership, with strong earnings, resilient margins and a favorable policy backdrop keeping the theme dominant.

-

The analysis highlights a tension: unprecedented capex meets uncertain revenue timing, creating a leverage cycle that raises system-wide sensitivity to rate and liquidity shocks.

-

Traditional diversification is losing power as a few structural forces drive returns, pushing investors toward more active, selective risk-taking.

For a fuller view of how these mega forces could reshape growth, leverage and portfolio construction, the full commentary lays out the deeper architecture behind the outlook.

Registreer of log in om verder te lezen. Investment Officer is een onafhankelijk journalistiek platform voor professionals werkzaam in de Belgische beleggingsindustrie.

Een abonnement is GRATIS voor professionals die werkzaam zijn bij banken en onafhankelijke vermogensbeheerders.