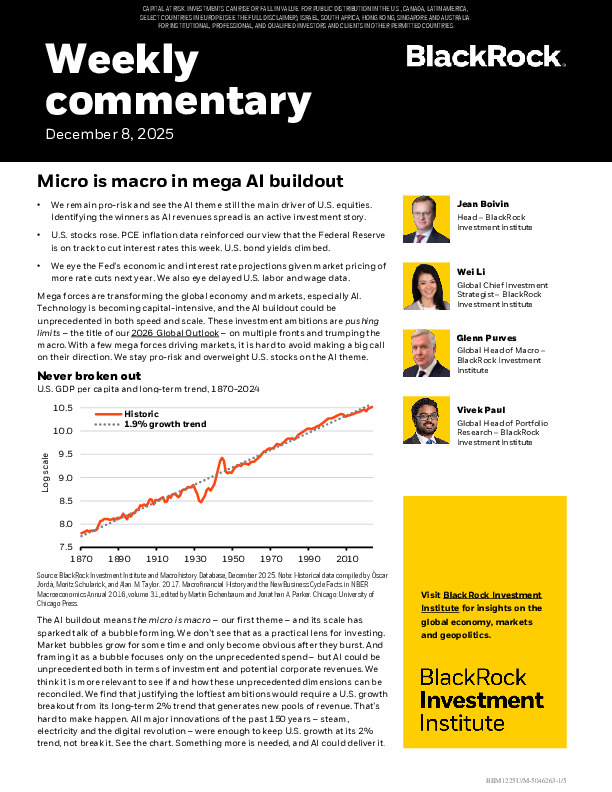

AI’s Buildout Turns Micro Trends Into Macro Forces

BlackRock’s latest commentary frames the AI expansion as a structural engine now shaping market direction, capital flows and investor positioning.

-

The investment surge behind AI is redefining U.S. equity leadership, with strong earnings, resilient margins and a favorable policy backdrop keeping the theme dominant.

-

The analysis highlights a tension: unprecedented capex meets uncertain revenue timing, creating a leverage cycle that raises system-wide sensitivity to rate and liquidity shocks.

-

Traditional diversification is losing power as a few structural forces drive returns, pushing investors toward more active, selective risk-taking.

For a fuller view of how these mega forces could reshape growth, leverage and portfolio construction, the full commentary lays out the deeper architecture behind the outlook.

Enregistrez-vous ou connectez-vous pour lire la suite. Investment Officer est une plateforme journalistique indépendante à destination des professionnels de l’industrie belge des investissements.

L’abonnement est GRATUIT pour les professionnels actifs au sein de banques et gestionnaires d’actifs indépendants.