Cyclical Small Caps Approach an Inflection Point as Valuations and Policy Align

Drawing on Van Lanschot Kempen’s latest analysis, the report outlines why a deeply out-of-favour segment may be nearing a turn.

-

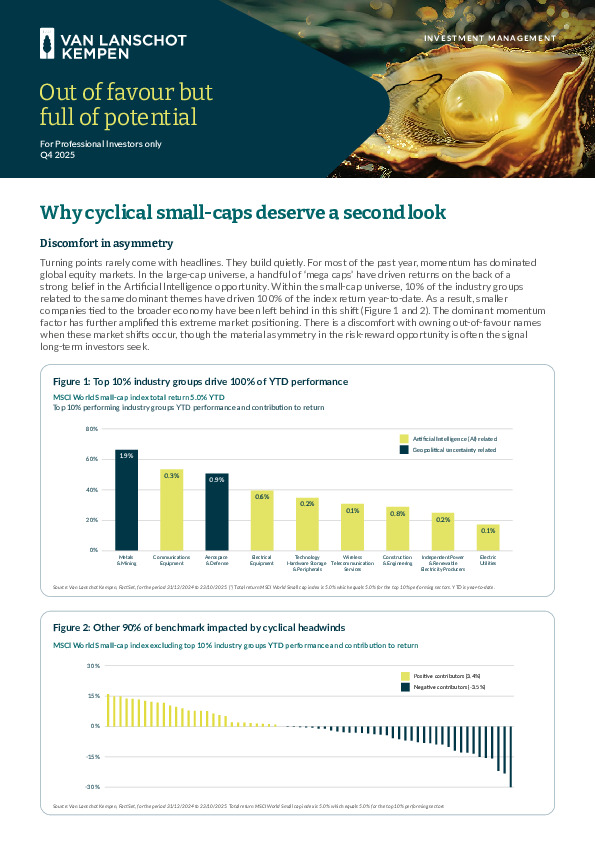

Prolonged industrial, consumer and manufacturing downcycles have weighed on small caps, yet easing-rate expectations historically mark the early stages of their outperformance.

-

Europe’s fiscal push—particularly Germany’s sizeable infrastructure and defence stimulus—could reignite demand and amplify operating leverage across smaller firms.

-

Valuations sit well below long-term averages, creating a favourable asymmetry in risk-reward should economic conditions stabilise.

If you’re assessing where cyclical exposure may begin to pay off again, the full report provides the detailed signals behind this potential shift.

Registreer of log in om verder te lezen. Investment Officer is een onafhankelijk journalistiek platform voor professionals werkzaam in de Belgische beleggingsindustrie.

Een abonnement is GRATIS voor professionals die werkzaam zijn bij banken en onafhankelijke vermogensbeheerders.