Cyclical Small Caps Approach an Inflection Point as Valuations and Policy Align

Drawing on Van Lanschot Kempen’s latest analysis, the report outlines why a deeply out-of-favour segment may be nearing a turn.

-

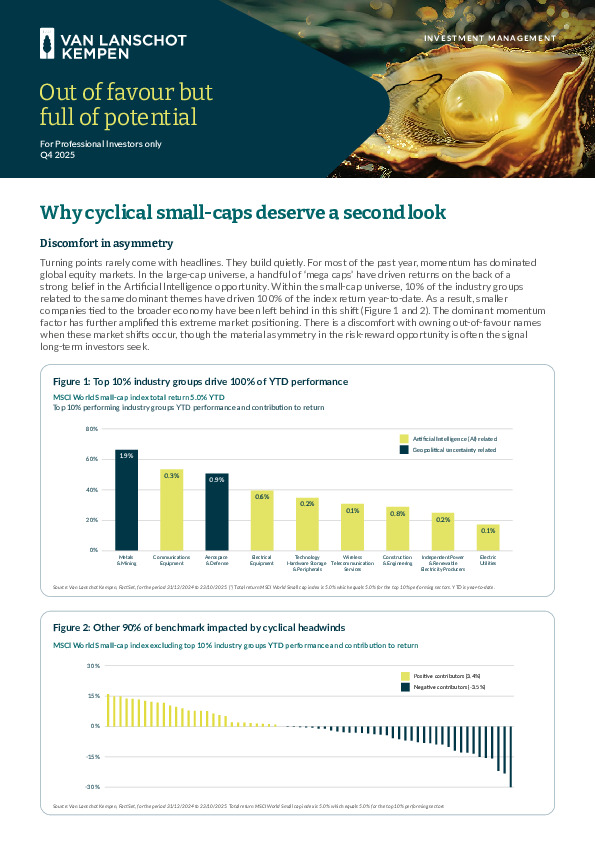

Prolonged industrial, consumer and manufacturing downcycles have weighed on small caps, yet easing-rate expectations historically mark the early stages of their outperformance.

-

Europe’s fiscal push—particularly Germany’s sizeable infrastructure and defence stimulus—could reignite demand and amplify operating leverage across smaller firms.

-

Valuations sit well below long-term averages, creating a favourable asymmetry in risk-reward should economic conditions stabilise.

If you’re assessing where cyclical exposure may begin to pay off again, the full report provides the detailed signals behind this potential shift.

Enregistrez-vous ou connectez-vous pour lire la suite. Investment Officer est une plateforme journalistique indépendante à destination des professionnels de l’industrie belge des investissements.

L’abonnement est GRATUIT pour les professionnels actifs au sein de banques et gestionnaires d’actifs indépendants.