Aligning Portfolios with the Low-Carbon Transition: Climate Transition Euro Corporate Bond Strategy

State Street Global Advisors outlines how its Climate Transition Euro Corporate Bond Beta Strategy integrates sustainability screening with index-based efficiency to capture long-term value in the Euro corporate bond market.

-

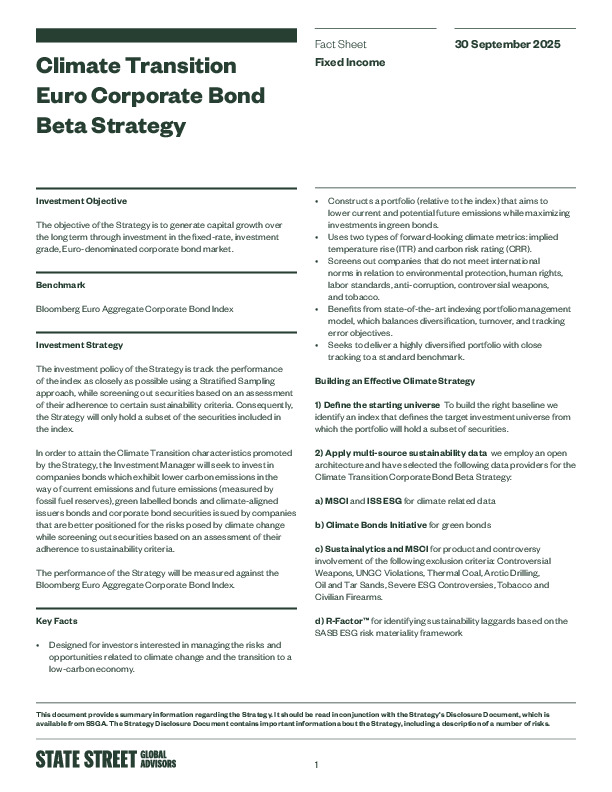

Investment focus: Tracks the Bloomberg Euro Aggregate Corporate Bond Index while excluding high-emission or non-compliant issuers and prioritizing green and climate-aligned bonds.

-

Performance: Delivered 2.78% YTD (gross) as of Q3 2025, closely matching the benchmark’s 2.76%.

-

Methodology: Uses implied temperature rise (ITR) and carbon risk rating (CRR) metrics to tilt toward issuers best positioned for the low-carbon transition.

How might this data-driven, indexed approach help investors combine climate impact with benchmark-level efficiency?

Registreer of log in om verder te lezen. Investment Officer is een onafhankelijk journalistiek platform voor professionals werkzaam in de Belgische beleggingsindustrie.

Een abonnement is GRATIS voor professionals die werkzaam zijn bij banken en onafhankelijke vermogensbeheerders.