Aligning Portfolios with the Low-Carbon Transition: Climate Transition Euro Corporate Bond Strategy

State Street Global Advisors outlines how its Climate Transition Euro Corporate Bond Beta Strategy integrates sustainability screening with index-based efficiency to capture long-term value in the Euro corporate bond market.

-

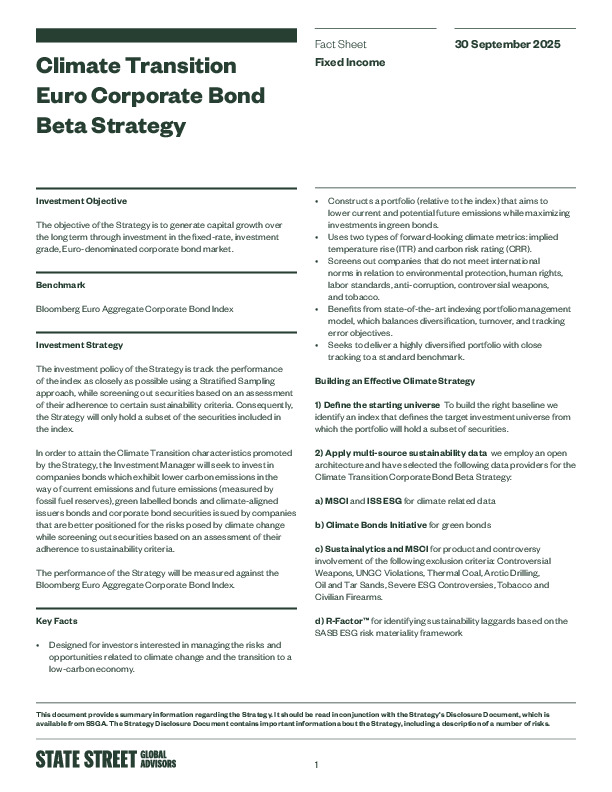

Investment focus: Tracks the Bloomberg Euro Aggregate Corporate Bond Index while excluding high-emission or non-compliant issuers and prioritizing green and climate-aligned bonds.

-

Performance: Delivered 2.78% YTD (gross) as of Q3 2025, closely matching the benchmark’s 2.76%.

-

Methodology: Uses implied temperature rise (ITR) and carbon risk rating (CRR) metrics to tilt toward issuers best positioned for the low-carbon transition.

How might this data-driven, indexed approach help investors combine climate impact with benchmark-level efficiency?

Enregistrez-vous ou connectez-vous pour lire la suite. Investment Officer est une plateforme journalistique indépendante à destination des professionnels de l’industrie belge des investissements.

L’abonnement est GRATUIT pour les professionnels actifs au sein de banques et gestionnaires d’actifs indépendants.