Schroders - Views and Insights

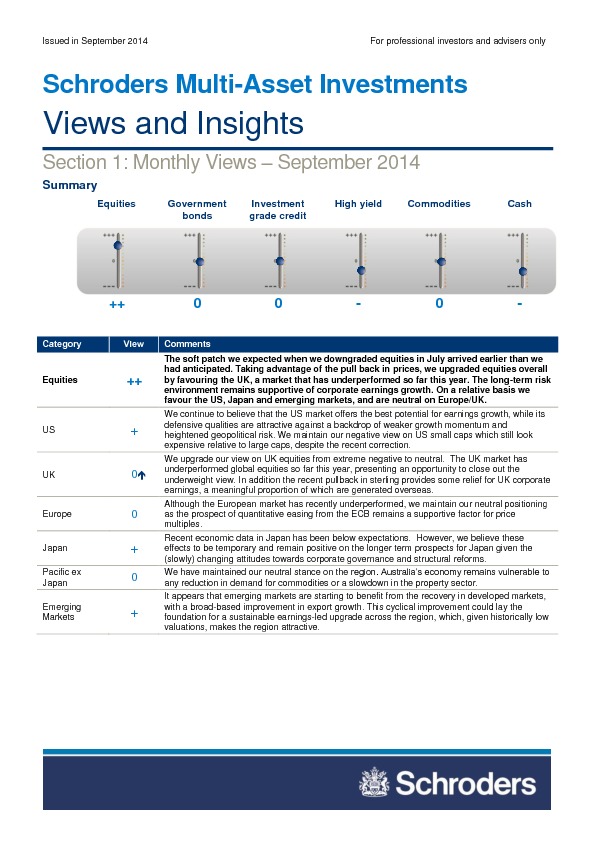

Schroders says that in equities, the soft patch they expected when they downgraded equities in July arrived earlier than they had anticipated. Taking advantage of the pull back in prices, they upgraded equities overall by favouring the UK, a market that has underperformed so far this year. On a relative basis Schroders favours the US, Japan and emerging markets, and are neutral on Europe/UK. In government bonds they recognise that duration is trading towards the lower end of their expected range and although they continue to expect a gradual recovery in the US. Additional liquidity provided by the European Central Bank (ECB) and Bank of Japan (BoJ) offsets marginal tightening in the US. Schroders says that geopolitical risks remain high.

Registreer of log in om verder te lezen. Investment Officer is een onafhankelijk journalistiek platform voor professionals werkzaam in de Belgische beleggingsindustrie.

Een abonnement is GRATIS voor professionals die werkzaam zijn bij banken en onafhankelijke vermogensbeheerders.