The AI Revolution and the Future of Growth Investing

An MFS Market Insights note features Brad Mak, Growth Portfolio Manager, outlining how the AI build-out is reshaping growth investing across sectors and time horizons.

-

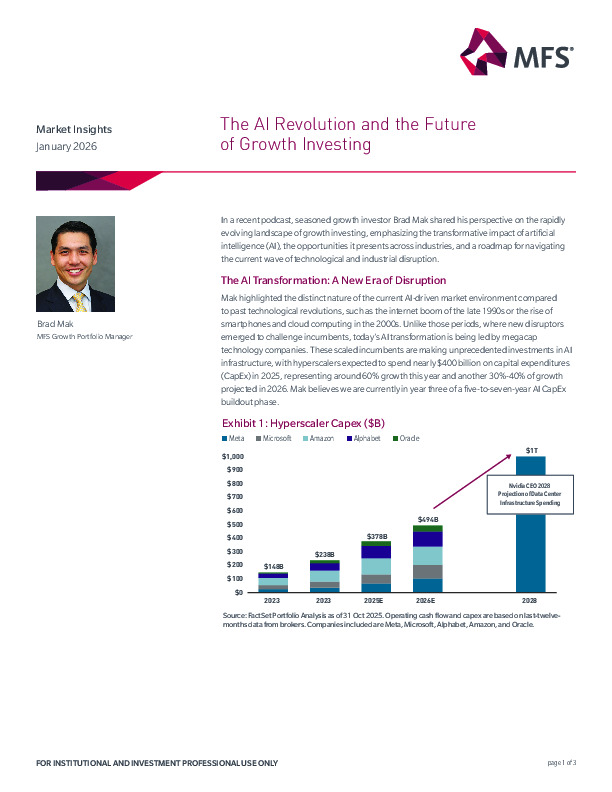

Hyperscalers are driving the cycle, with AI CapEx nearing $400bn in 2025 and a 5–7 year build-out still in its early stages.

-

AI’s spillovers extend beyond technology, lifting growth prospects in energy, capital goods, healthcare and industrial automation.

-

Valuations remain below prior tech-bubble peaks; risks centre on cycle duration, overcapacity and demand—but leverage in data-centre financing is still limited.

Explore the full insight for sector-level opportunities, adoption dynamics and risk frameworks shaping long-term growth portfolios.

Registreer of log in om verder te lezen. Investment Officer is een onafhankelijk journalistiek platform voor professionals werkzaam in de Belgische beleggingsindustrie.

Een abonnement is GRATIS voor professionals die werkzaam zijn bij banken en onafhankelijke vermogensbeheerders.