Late-Cycle Markets Lean on Policy and Valuation Divergence

Global Investment Views brings together Amundi’s CIO team to frame how slowing U.S. growth, muted Eurozone demand, and stretched valuations are shaping cross-asset positioning into year-end

-

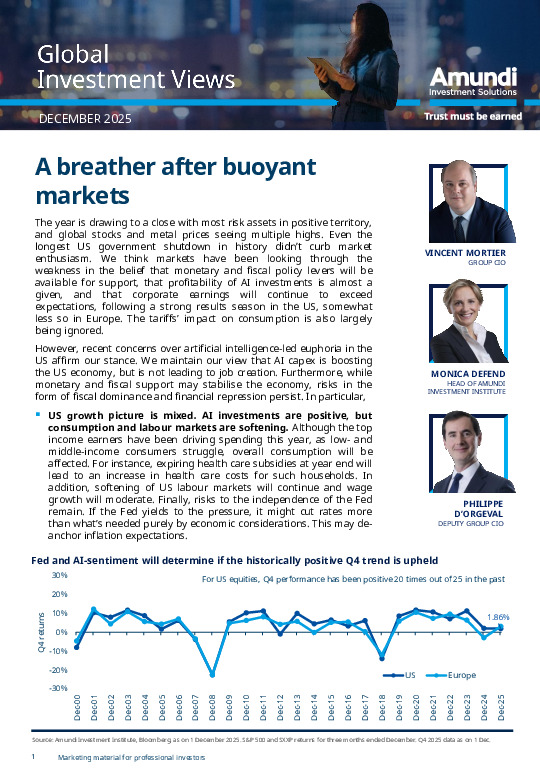

AI-driven capex supports U.S. activity, yet softening labour data and risks to Fed independence raise the odds of policy mis-steps, while Eurozone disinflation paves the way for two ECB cuts in 2026.

-

Allocation shifts favour Europe, Japan and selected EM markets where valuations and earnings trends are more compelling than in concentrated U.S. segments.

-

Duration views diverge: slightly positive on EU and Italian BTPs, cautious on the U.S. and UK, with EM debt and EU investment-grade credit supported by stable fundamentals.

For a deeper read on how these macro and valuation dynamics guide multi-asset positioning, explore the full publication.

Registreer of log in om verder te lezen. Investment Officer is een onafhankelijk journalistiek platform voor professionals werkzaam in de Belgische beleggingsindustrie.

Een abonnement is GRATIS voor professionals die werkzaam zijn bij banken en onafhankelijke vermogensbeheerders.