Selective Risk-Taking Returns as EM Equities Gain Appeal

The October 2025 CIO View – Portfolio Perspectives from DWS outlines a measured tilt back toward risk, supported by improving macro signals and strong liquidity conditions.

-

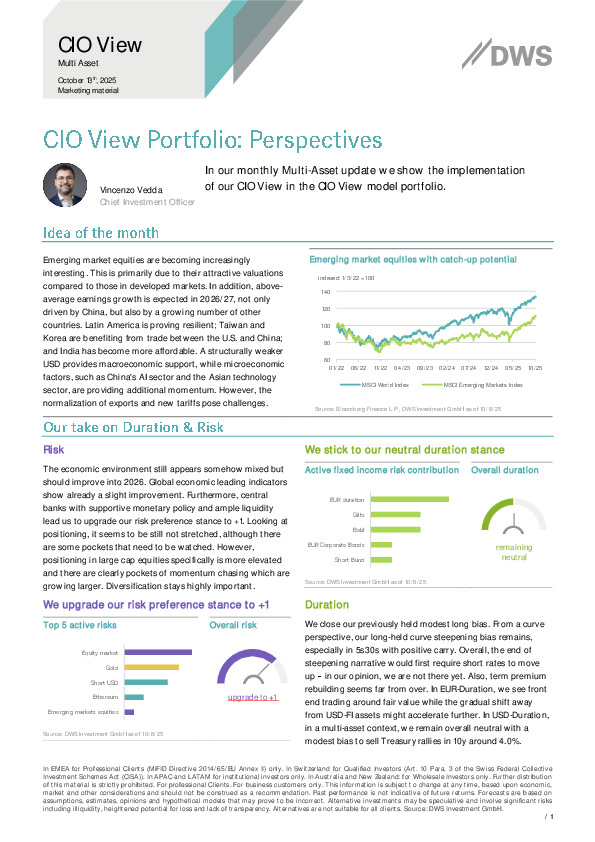

Emerging market equities are upgraded to +1, driven by attractive valuations, improving earnings momentum, and USD weakness; Asia benefits from AI-linked tech demand while Latin America remains resilient.

-

Overall risk stance moves to +1, supported by easier central bank policy and stabilizing global indicators, though DWS warns of crowded positioning in large caps and stresses diversification.

-

Neutral duration retained with a bias toward curve steepening, while EUR investment-grade credit stays favored over U.S. IG; currency positioning remains long EUR and JPY versus USD.

How can portfolios lean into EM growth without overexposure to late-cycle volatility? See the full positioning details in the report.

Registreer of log in om verder te lezen. Investment Officer is een onafhankelijk journalistiek platform voor professionals werkzaam in de Belgische beleggingsindustrie.

Een abonnement is GRATIS voor professionals die werkzaam zijn bij banken en onafhankelijke vermogensbeheerders.