Regulated Euro Stablecoins Bridge Traditional Finance and Blockchain Adoption

DWS’s CIO Special – Digital Assets (Oct 2025) highlights the growing institutional role of regulated stablecoins in global finance.

-

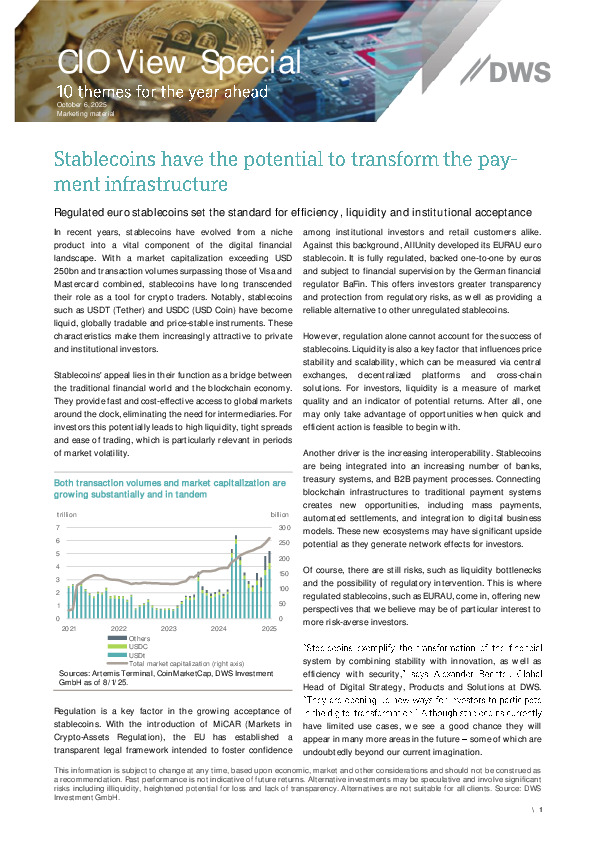

With USD 250bn+ in market cap and transaction volumes exceeding Visa and Mastercard, stablecoins have evolved into core settlement infrastructure for digital finance.

-

The EU’s MiCAR regulation is accelerating institutional adoption, enabling fully supervised instruments like AllUnity’s EURAU euro stablecoin, backed 1:1 and regulated by BaFin.

-

Liquidity, interoperability and integration with banking, treasury and B2B payment systems are driving new use cases—from automated settlements to cross-chain finance.

Are regulated stablecoins becoming the backbone of Europe’s digital financial architecture? Explore the full report for strategic implications.

Registreer of log in om verder te lezen. Investment Officer is een onafhankelijk journalistiek platform voor professionals werkzaam in de Belgische beleggingsindustrie.

Een abonnement is GRATIS voor professionals die werkzaam zijn bij banken en onafhankelijke vermogensbeheerders.