Deep Value at Decade Lows: A Rare Entry Point for Valuation-Driven Investors

GMO’s July 2025 Asset Allocation update revisits the case for value investing, highlighting the historically extreme discounts now seen in both U.S. and international markets.

-

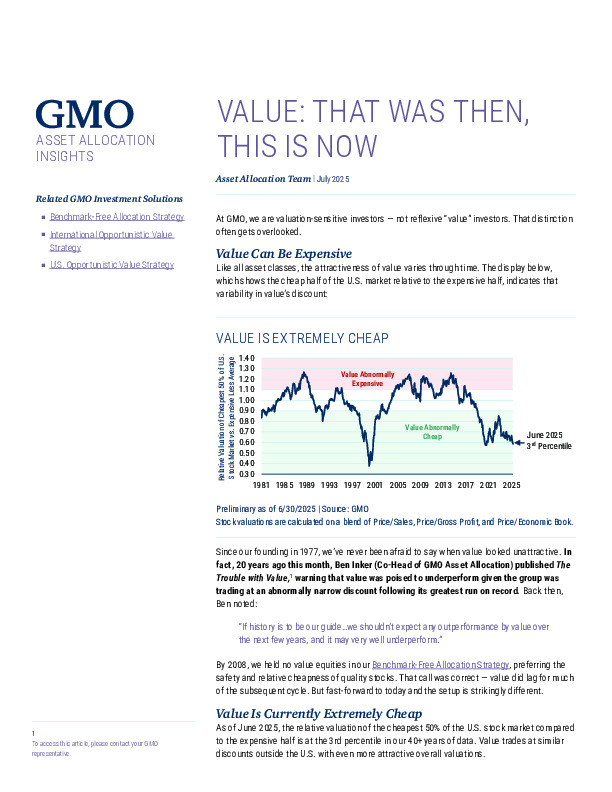

Valuation dislocation: The cheapest half of U.S. equities trades at the 3rd percentile relative to expensive stocks in over 40 years of data, signaling deep value appeal.

-

Selective implementation: GMO favors the bottom 20% of stocks by valuation, which offer both cheaper pricing and better fundamentals than broad value indices.

-

Discipline over labels: Past cycles inform today’s positioning—value isn't always attractive, but current market conditions call for valuation-based exposure.

Is your portfolio aligned to capture one of the strongest deep value signals in decades? The full report details GMO’s allocation shifts and strategic conviction.

Registreer of log in om verder te lezen. Investment Officer is een onafhankelijk journalistiek platform voor professionals werkzaam in de Belgische beleggingsindustrie.

Een abonnement is GRATIS voor professionals die werkzaam zijn bij banken en onafhankelijke vermogensbeheerders.