Cautious Positioning Amid Uncertainty: Managing Multi-Asset Risk in a Diverging World

In its June 2025 Multi-Asset CIO View, DWS outlines how recent macro signals and geopolitical shifts are shaping portfolio allocations and risk assessments.

-

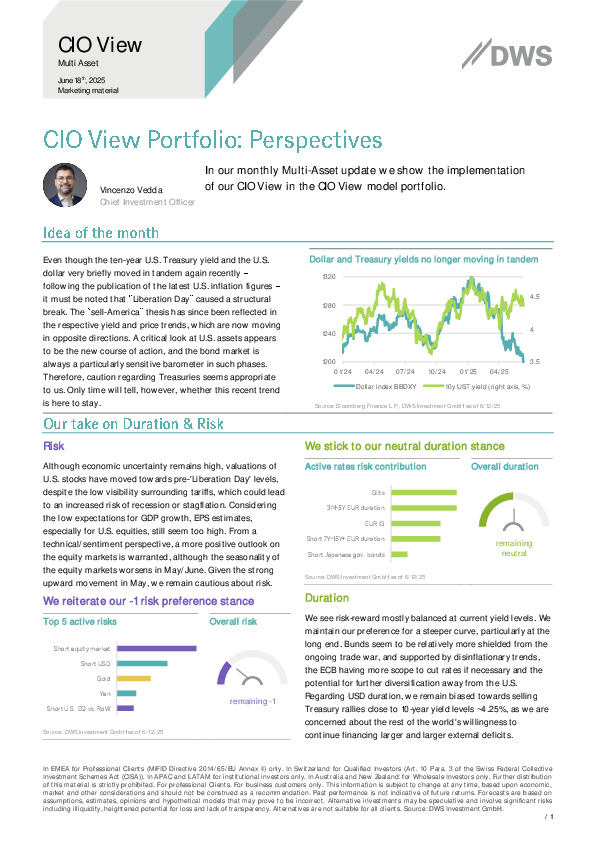

U.S. equities remain vulnerable to elevated valuations and tariff-related risks, prompting continued underweight and a tilt toward healthcare and minimum volatility strategies.

-

The firm maintains a neutral duration stance, preferring long-end steepeners and expressing caution on U.S. Treasuries due to external financing concerns.

-

EUR investment-grade credit is favored over sovereigns and USD IG, supported by resilient fundamentals and a more attractive risk-return profile.

For insights on how DWS tactically adjusts in a shifting global regime, consult the full portfolio perspective.

Registreer of log in om verder te lezen. Investment Officer is een onafhankelijk journalistiek platform voor professionals werkzaam in de Belgische beleggingsindustrie.

Een abonnement is GRATIS voor professionals die werkzaam zijn bij banken en onafhankelijke vermogensbeheerders.