Shifting Liquidity Dynamics a Potential US Equity Headwind

n this April 2025 Strategist’s Corner, MFS’s Robert Almeida explores how tightening liquidity conditions and macro headwinds may reshape equity performance, especially in the U.S. market.

- Elevated trading volumes in April contrast with diminished liquidity, amplifying volatility and exposing vulnerable assets.

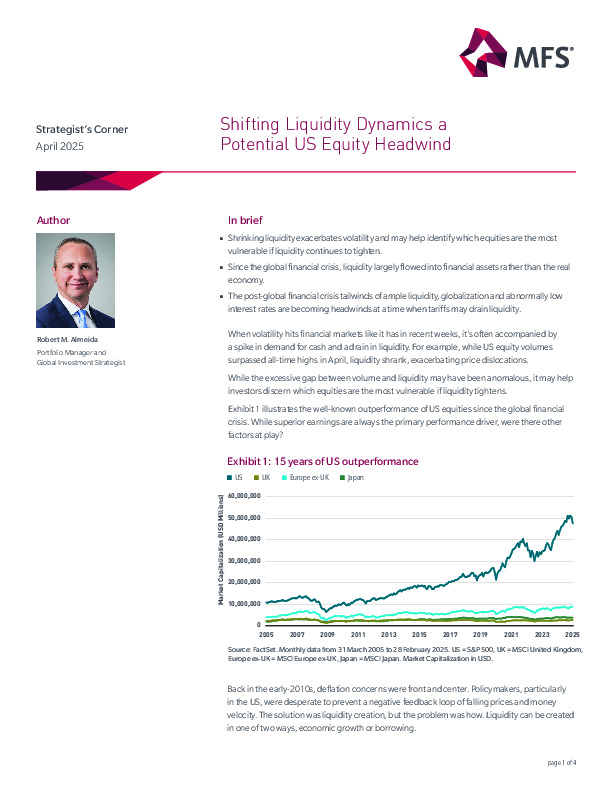

- U.S. equities have long benefited from post-GFC tailwinds—low rates, globalization, and stimulus-fueled liquidity—but these are now turning into headwinds.

- Liquidity-driven outperformance is fading, and higher-duration U.S. tech stocks are increasingly sensitive to liquidity shocks.

Read the full report for insights into how shrinking liquidity and global policy shifts could alter long-term equity strategy.

Registreer of log in om verder te lezen. Investment Officer is een onafhankelijk journalistiek platform voor professionals werkzaam in de Belgische beleggingsindustrie.

Een abonnement is GRATIS voor professionals die werkzaam zijn bij banken en onafhankelijke vermogensbeheerders.