During the coronavirus downturn and rebound, US growth stocks outpaced value stocks by a record margin. Now growth stocks seem expensive, but that depends on how you look at it. So are these trends likely to continue—and how should investors position across different equity styles?

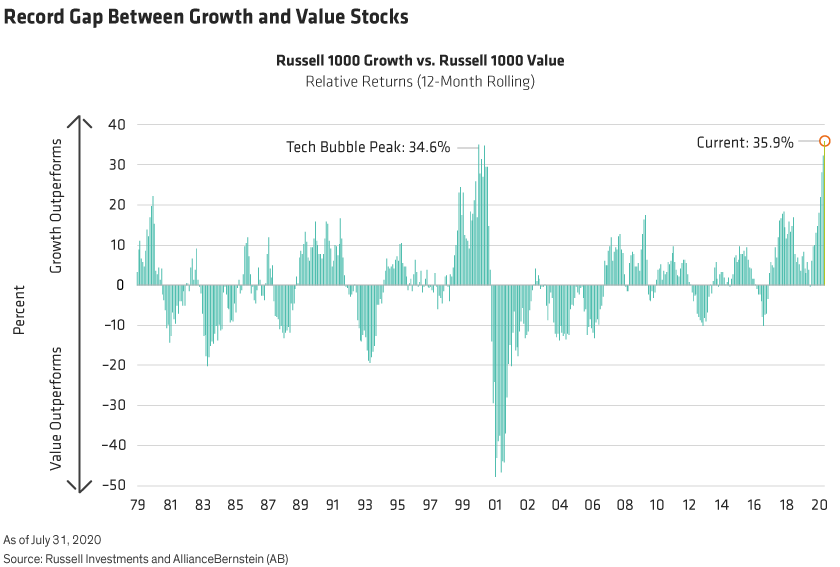

US growth stocks surged for much of 2020. One of the most extreme examples is Apple, which is now worth more than $2 trillion. Through August 18th, the Russell 1000 Growth Index advanced by 23.4%, outperforming the Russell 1000 Value Index by about 34%. Over the 12-month period ending July 31, US growth stocks beat value stocks by a record margin, even more than the outperformance recorded before the dotcom bubble burst in 2000 (Display). Now investors are trying to figure out whether these market trends will persist amid challenges ranging from the battle against COVID-19, US elections and China-US tensions.

Sector Weights Fuel Performance

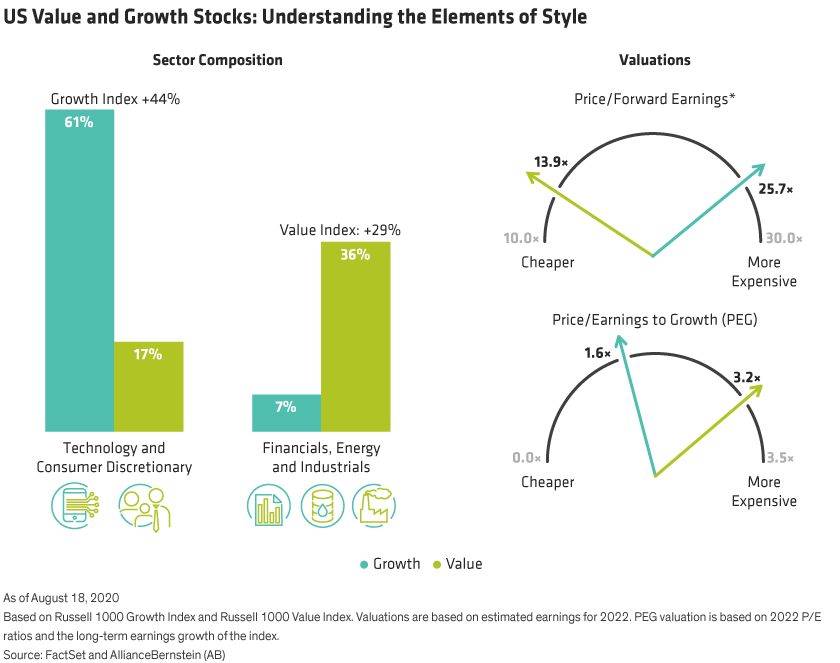

What’s behind these performance patterns? Each index is tilted toward different sectors/themes and not by design (Display, left). Currently, the growth index has very large weights in consumer discretionary and technology stocks. Meanwhile, the value index is heavily concentrated in cyclical sectors such as financials, industrials and energy—which are all facing acute challenges amid the coronavirus recession and other macroeconomic forces. As a result, its performance is often heavily influenced by government policies, the direction of oil prices (which are now stabilizing) and interest rates (which aren’t likely to rise for the foreseeable future).

Are Growth Stocks Overpriced? It Depends.

Valuations are also tricky (Display above, right). Based on price/forward earnings for 2022—perhaps the most popular valuation metric—value stocks are trading at an 85% valuation discount to growth stocks, which are trading at 25.7 times estimates earnings for 2022. At face value, growth stocks look more expensive.

Yet when accounting for the higher level of growth that these companies are expected to deliver, those valuations are actually much more reasonable. Indeed, based on price/earnings to growth (PEG) for 2022, when earnings are expected to stabilize after this year’s collapse, the value index is twice as expensive as the growth index.

Nearly two years ago, we looked at similar trends and argued that a simplistic choice between value and growth was inappropriate after a nine-year bull market and at a late stage in the US economic cycle. While market and macroeconomic conditions have changed dramatically since the pandemic began, we believe the statement is still true today. That said, volatility is likely to stay elevated and market risks are much greater today, given valuations, macroeconomic and regulatory risks (such as potential legislation for the technology industry). For many companies—particularly within the value universe—solvency concerns are much greater than usual because of the pandemic.

Selective investors can find attractive candidates in both styles. Companies with solid balance sheets and low levels of debt that don’t depend on the economic cycle for growth are good growth candidates to pull through the crisis, in our view. On the value side, stocks with attractive valuations that have higher quality balance sheets and cash flows are worth considering. Investors should look beyond the style indices for active strategies that aim to find the most promising sources of return potential through the coronavirus crisis and the long-term recovery.

-

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams and are subject to revision over time.

About the Authors

Scott Krauthamer is a Senior Vice President and Global Head of Product Management & Strategy, overseeing AB's global investment products across the firm's equity, fixed income and multi-asset strategies. Prior to joining the firm, he held a variety of investment and product-management roles at Legg Mason, U.S. Trust, Bank of America and J.P. Morgan Private Bank. Krauthamer started his career as an analyst at J.P. Morgan in 1998, and his financial-services experience spans investment-management, quantitative analysis, marketing and business development. He holds a BS in finance and management information systems from the State University of New York, Albany, and is a CFA charterholder and a CAIA designee. Location: Nashville

Robert Milano is the Product Specialist for AB's Select US Equity and US Growth portfolios. His primary responsibilities include monitoring and communicating portfolio positioning and analysis, client servicing and operations. Milano was previously a member of the fixed-income product management team, where he focused on the taxable and municipal US Retail business. He holds a BS in finance from Manhattan College. Location: New York