Emerging Market Debt Is Bigger—and Stronger—Than Investors Assume

Rather than a niche allocation, this RBC BlueBay analysis reframes emerging market debt as a core fixed-income asset class grounded in scale, credit quality, and improving fundamentals.

-

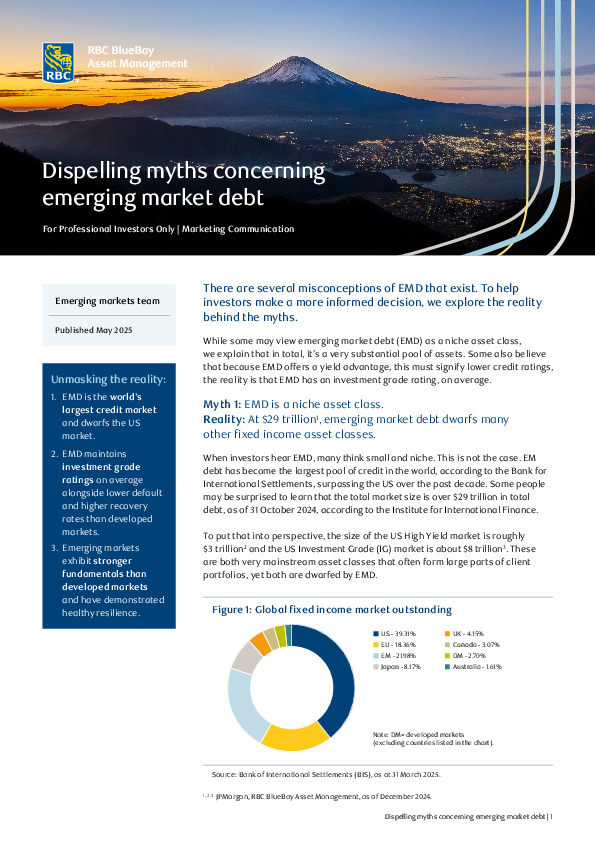

At roughly $29 trillion outstanding, emerging market debt now exceeds the size of the U.S. credit market and dwarfs U.S. high yield and investment-grade segments.

-

On average, EMD carries an investment-grade rating, with lower default rates and higher recoveries than developed-market credit.

-

Sovereign and corporate fundamentals have strengthened, with lower debt-to-GDP ratios, improving ratings trends, and greater resilience to macro shocks.

Is EMD being mispriced by outdated perceptions rather than current realities? The full report examines where opportunity lies beneath persistent myths.

Enregistrez-vous ou connectez-vous pour lire la suite. Investment Officer est une plateforme journalistique indépendante à destination des professionnels de l’industrie belge des investissements.

L’abonnement est GRATUIT pour les professionnels actifs au sein de banques et gestionnaires d’actifs indépendants.