Mega Forces Set the Frame as Markets Reprice Risk in 2026

This weekly commentary from the BlackRock Investment Institute distills lessons from 2025’s volatility to guide portfolio positioning into 2026, drawing on analysis from its senior investment leadership

-

Immutable economic constraints limited policy extremes in 2025, allowing risk assets to recover despite sharp interim drawdowns.

-

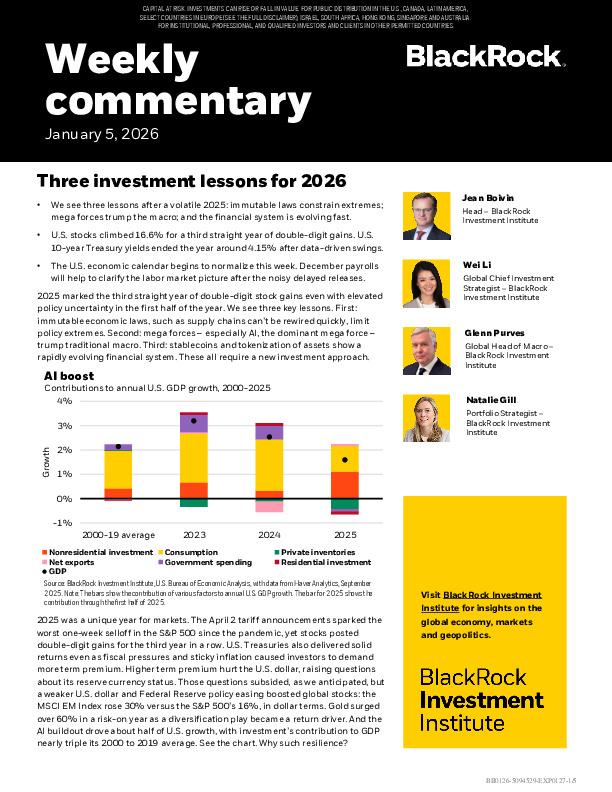

Mega forces, led by AI, are now the primary drivers of growth and returns, weakening traditional macro anchors and favoring active risk-taking.

-

A rapidly evolving financial system, via stablecoins and tokenization, is reshaping capital flows, diversification, and the role of the U.S. dollar.

Read the full commentary to unpack how these forces translate into concrete asset allocation and risk management choices for 2026.

Enregistrez-vous ou connectez-vous pour lire la suite. Investment Officer est une plateforme journalistique indépendante à destination des professionnels de l’industrie belge des investissements.

L’abonnement est GRATUIT pour les professionnels actifs au sein de banques et gestionnaires d’actifs indépendants.