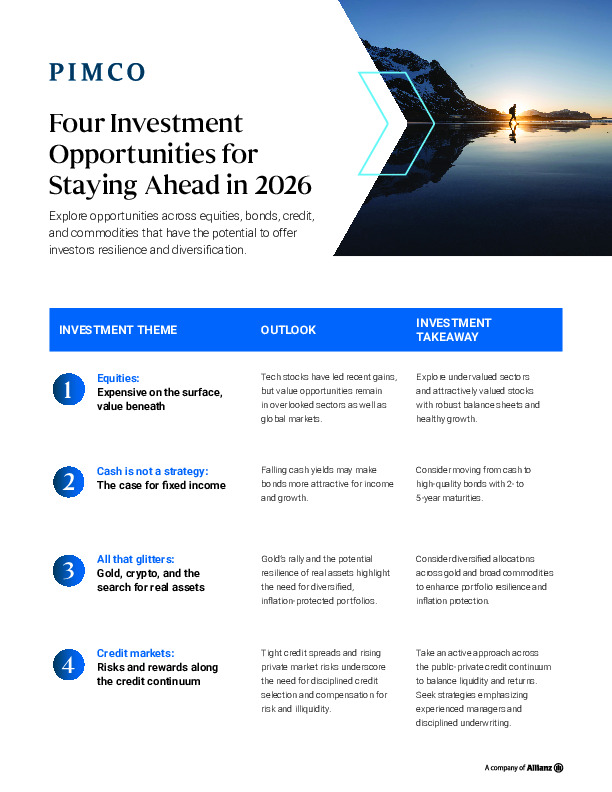

Four Cross-Asset Levers for Navigating 2026’s Late-Cycle Markets

The featured report outlines a cross-asset framework to help investors stay ahead in 2026, drawing on macro, valuation, and liquidity dynamics across global markets.

-

Equities appear expensive at the index level, but selective value persists across sectors and regions with stronger balance sheets.

-

As cash yields decline, high-quality fixed income regains appeal for income, diversification, and downside resilience.

-

Tight credit spreads and elevated private-market risks call for disciplined, active positioning across public and private credit.

The full note details how these themes interact—and where portfolios can be repositioned as late-cycle risks and opportunities converge.

Enregistrez-vous ou connectez-vous pour lire la suite. Investment Officer est une plateforme journalistique indépendante à destination des professionnels de l’industrie belge des investissements.

L’abonnement est GRATUIT pour les professionnels actifs au sein de banques et gestionnaires d’actifs indépendants.