AI’s Boom Phase Brings Volatility—and Selectivity

DWS’s CIO Special frames artificial intelligence as a structural growth engine entering a more volatile, capital-intensive phase that will increasingly separate durable winners from fragile narratives.

-

AI investment remains a key driver of expected double-digit earnings growth, underpinning a constructive outlook for U.S. equities even as volatility rises.

-

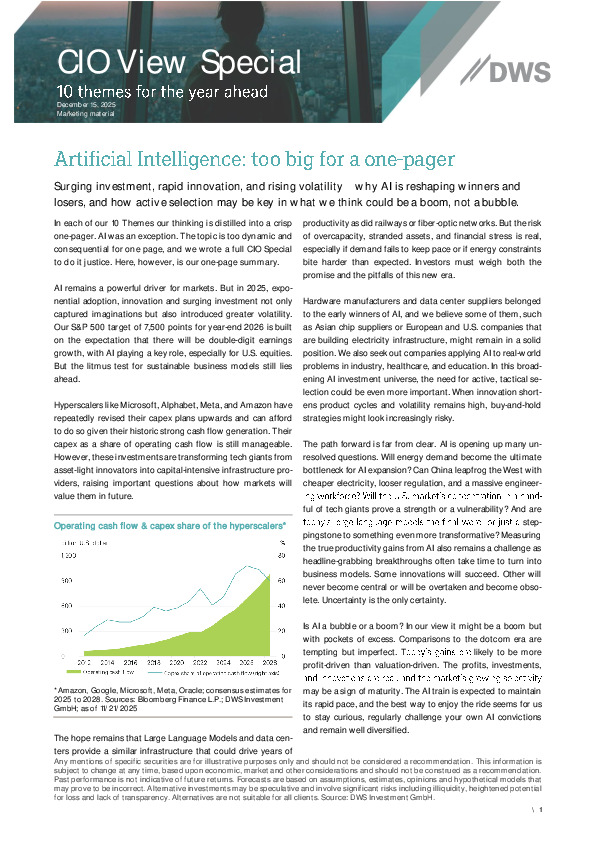

Hyperscalers’ expanding capex is reshaping them into infrastructure providers, raising questions around future returns, energy constraints and potential overcapacity.

-

The opportunity set is broadening from early hardware winners to firms applying AI in industry, healthcare and education, making active selection more critical.

To assess where the boom may endure—and where excess could form—the full CIO Special explores the trade-offs in far greater depth.

Enregistrez-vous ou connectez-vous pour lire la suite. Investment Officer est une plateforme journalistique indépendante à destination des professionnels de l’industrie belge des investissements.

L’abonnement est GRATUIT pour les professionnels actifs au sein de banques et gestionnaires d’actifs indépendants.