Positioning for a Gradual Turn in 2026

DWS’s latest portfolio update outlines a cautiously constructive stance as fiscal clarity, easier policy and improving leading indicators shape the near-term investment landscape.

-

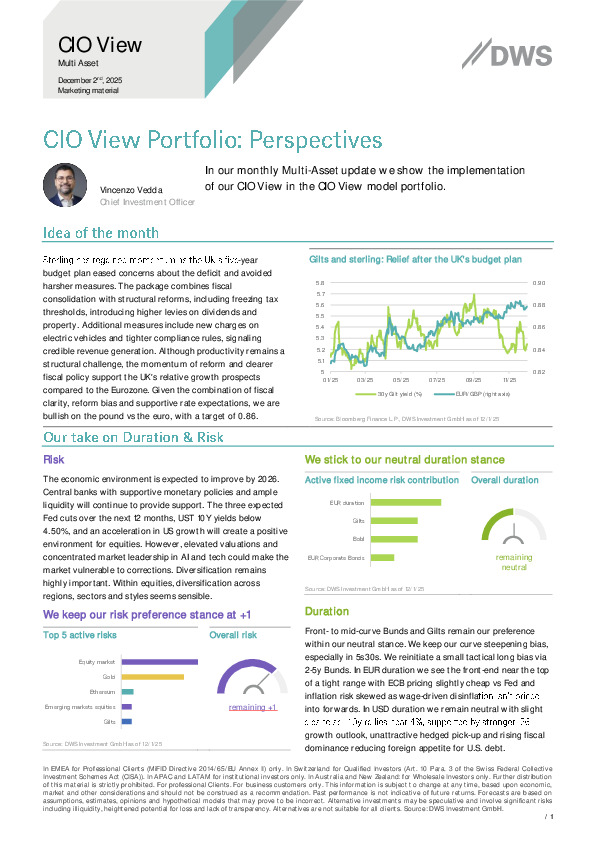

UK asset sentiment stabilised after a clearer budget path, supporting a stronger pound against the euro and easing pressure in gilts.

-

The team keeps a +1 risk stance, leaning on emerging markets, healthcare and value as earnings momentum broadens while tech valuations stay stretched.

-

Duration remains neutral, with preference for Bunds and gilts over U.S. Treasuries as fiscal dominance tempers foreign demand for U.S. debt.

If you want a closer read on how these themes translate into multi-asset positioning, the full report maps each tilt with precision.

Enregistrez-vous ou connectez-vous pour lire la suite. Investment Officer est une plateforme journalistique indépendante à destination des professionnels de l’industrie belge des investissements.

L’abonnement est GRATUIT pour les professionnels actifs au sein de banques et gestionnaires d’actifs indépendants.