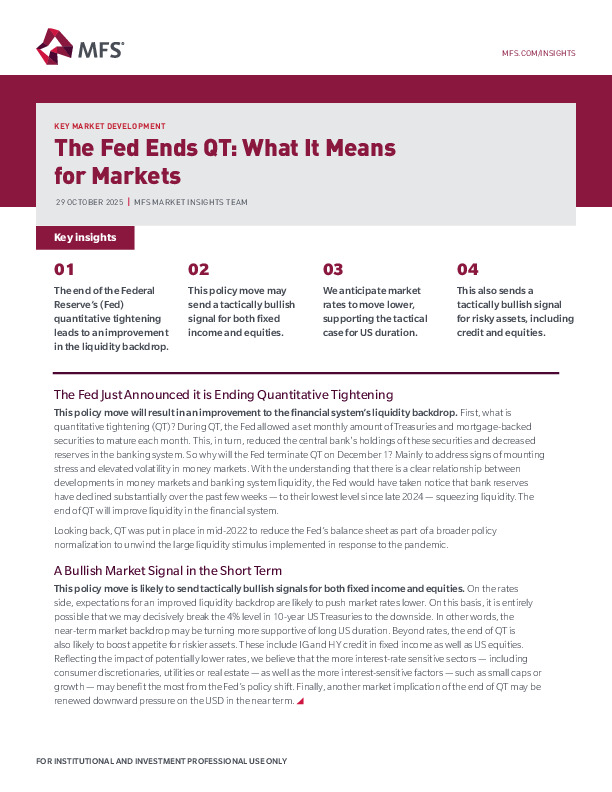

Fed Ends Quantitative Tightening: Liquidity Boost Sparks Tactical Bullish Outlook

This report from the MFS Market Insights Team (October 29, 2025) examines the Federal Reserve’s decision to end Quantitative Tightening (QT) and its implications for markets and liquidity.

-

The Fed’s termination of QT on December 1 aims to ease mounting stress in money markets and improve banking system liquidity.

-

MFS expects lower market rates and a near-term bullish signal for both fixed income and equities, particularly rate-sensitive sectors.

-

Renewed downward pressure on the USD may accompany increased risk appetite for credit and equities.

Explore the full report for detailed analysis on positioning, sector impacts, and liquidity dynamics.

Enregistrez-vous ou connectez-vous pour lire la suite. Investment Officer est une plateforme journalistique indépendante à destination des professionnels de l’industrie belge des investissements.

L’abonnement est GRATUIT pour les professionnels actifs au sein de banques et gestionnaires d’actifs indépendants.