QT Nears Its End as Credit Markets and Trade Uncertainty Test Resilience

Northern Trust’s Weekly Economic Commentary (24 Oct 2025) examines how tightening liquidity, credit stress, and trade fragmentation are reshaping financial conditions.

-

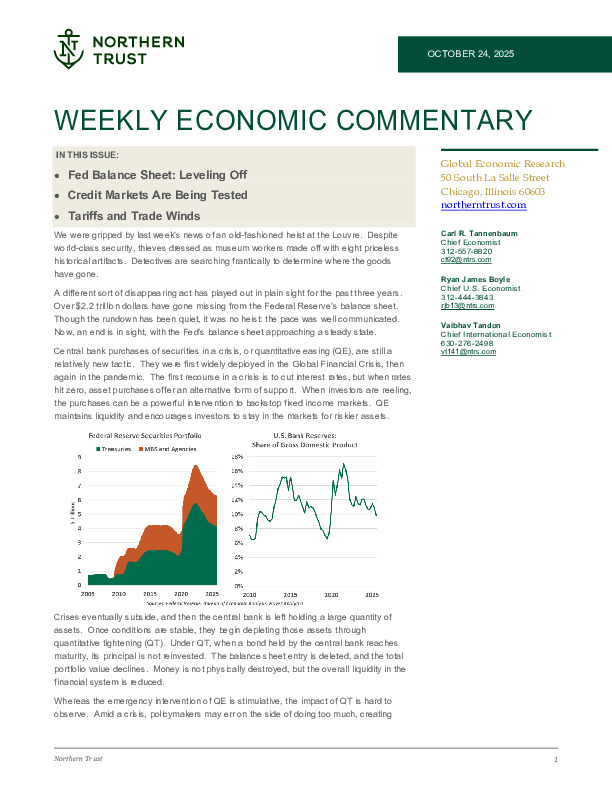

The Fed’s balance sheet runoff is nearing completion, with reserves shifting from “abundant” to “ample.” Chair Powell signaled that the Fed may soon pause QT to prevent renewed market strain.

-

The First Brands bankruptcy reignited concerns about private credit opacity and contagion risk as leveraged loans, CLOs, and private debt funds face closer scrutiny.

-

Meanwhile, rising trade policy uncertainty and tariff escalation threaten to slow global growth and undermine productivity gains, the IMF warns, as the world moves toward fragmented trade blocs.

Is the global economy entering a new phase of tighter liquidity and fractured globalization? The full Northern Trust report explores these converging risks.

Enregistrez-vous ou connectez-vous pour lire la suite. Investment Officer est une plateforme journalistique indépendante à destination des professionnels de l’industrie belge des investissements.

L’abonnement est GRATUIT pour les professionnels actifs au sein de banques et gestionnaires d’actifs indépendants.