Stablecoins Mature, Argentina Stabilizes, and U.S. Data Gaps Complicate Policy

Northern Trust’s Weekly Economic Commentary (Oct 10, 2025) explores rising financial innovation, geopolitical intervention, and the growing role of alternative data.

-

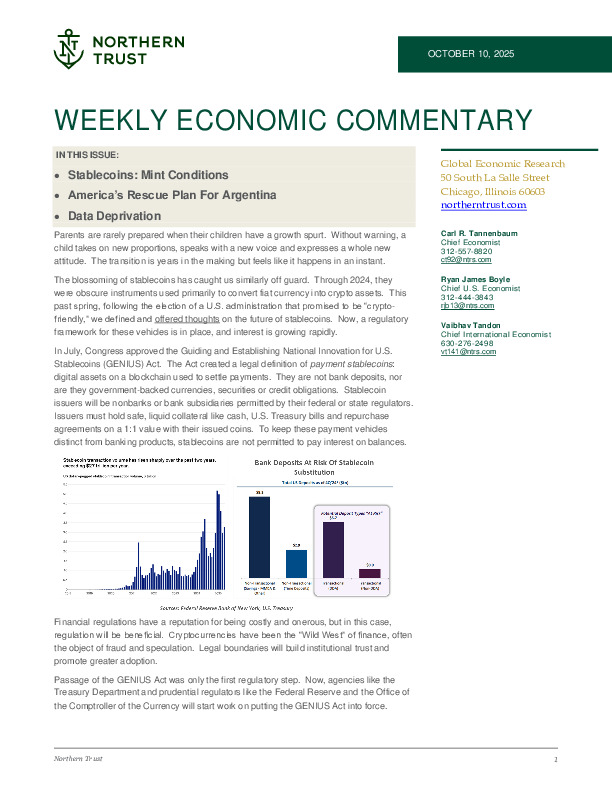

The GENIUS Act establishes the first U.S. regulatory framework for payment stablecoins, boosting institutional trust while raising questions on loopholes, bank funding pressure, and interoperability.

-

The U.S. extended a $20bn liquidity backstop to Argentina via the Exchange Stabilization Fund, calming markets temporarily but leaving structural risks—including depleted reserves and political fragility—unresolved.

-

The U.S. government shutdown delays key economic data, forcing investors and policymakers to turn to alternative labor and inflation indicators (ADP, LinkedIn, PriceStats), highlighting data reliability risks.

What could these shifts in regulation, geopolitics, and data transparency mean for global markets going forward? Read the full commentary for deeper implications.

Enregistrez-vous ou connectez-vous pour lire la suite. Investment Officer est une plateforme journalistique indépendante à destination des professionnels de l’industrie belge des investissements.

L’abonnement est GRATUIT pour les professionnels actifs au sein de banques et gestionnaires d’actifs indépendants.