Fundamental Strength Drives Long-Term Equity Returns

This report, authored by GMO’s Focused Equity team, analyzes a decade of performance in the Quality Strategy, highlighting how fundamental returns shape long-term outcomes.

-

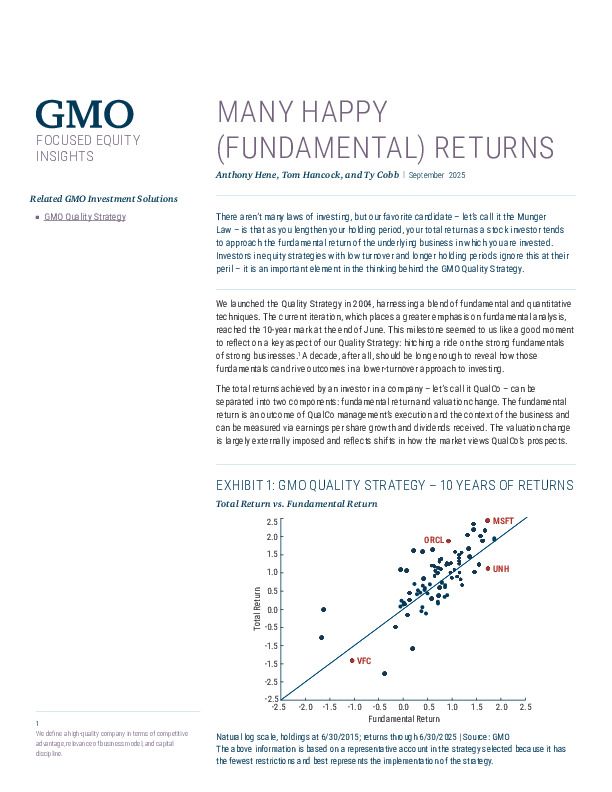

Over 10 years, fundamental returns proved the dominant driver of total returns, with Microsoft outperforming peers like VF Corporation by more than 10x due to sustained earnings growth.

-

Valuation changes mattered in the short term but diminished in impact over longer horizons, reinforcing the importance of business quality.

-

The Quality Strategy delivered a 10.35% annualized return since inception, broadly in line with the S&P 500.

What deeper lessons can long-term investors draw from the persistent pull of fundamentals? Explore the full report for detailed analysis and portfolio insights.

Enregistrez-vous ou connectez-vous pour lire la suite. Investment Officer est une plateforme journalistique indépendante à destination des professionnels de l’industrie belge des investissements.

L’abonnement est GRATUIT pour les professionnels actifs au sein de banques et gestionnaires d’actifs indépendants.