Northern Trust - Investment Strategy Commentary: Double Trouble Ahead?

We are increasingly getting questions about the potential to simultaneously lose money in fixed income and equities as interest rates creep lower and equity valuations are further extended. We explore that risk in this report – a situation we refer to as “double trouble.”

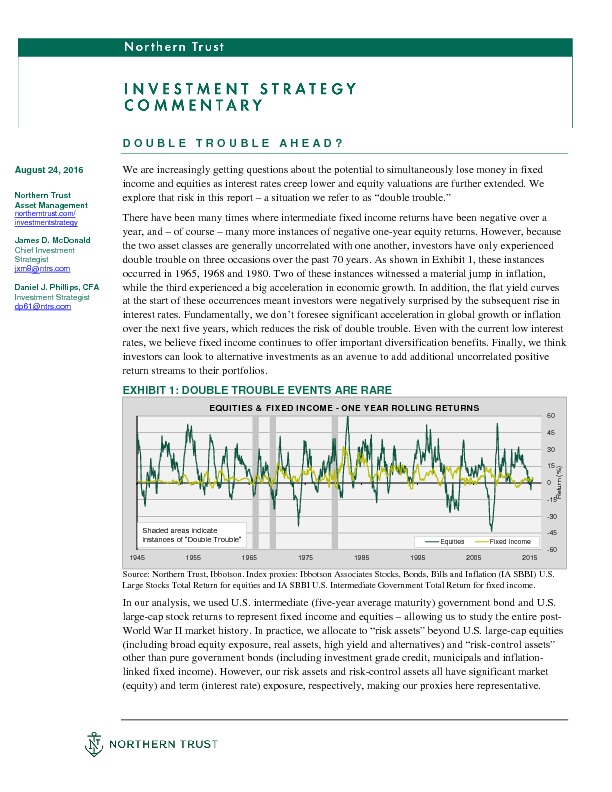

There have been many times where intermediate fixed income returns have been negative over a year, and – of course – many more instances of negative one-year equity returns. However, because the two asset classes are generally uncorrelated with one another, investors have only experienced double trouble on three occasions over the past 70 years. As shown in Exhibit 1, these instances occurred in 1965, 1968 and 1980. Two of these instances witnessed a material jump in inflation, while the third experienced a big acceleration in economic growth. In addition, the flat yield curves at the start of these occurrences meant investors were negatively surprised by the subsequent rise in interest rates. Fundamentally, we don’t foresee significant acceleration in global growth or inflation over the next five years, which reduces the risk of double trouble. Even with the current low interest rates, we believe fixed income continues to offer important diversification benefits. Finally, we think investors can look to alternative investments as an avenue to add additional uncorrelated positive return streams to their portfolios.

Enregistrez-vous ou connectez-vous pour lire la suite. Investment Officer est une plateforme journalistique indépendante à destination des professionnels de l’industrie belge des investissements.

L’abonnement est GRATUIT pour les professionnels actifs au sein de banques et gestionnaires d’actifs indépendants.