Dollar Weakness Looks Cyclical, Not the Start of De-Dollarisation

DWS’s CIO View Special analyses the dollar’s 7% decline this year and argues that recent volatility reflects tactical repositioning rather than a structural erosion of the greenback’s global role.

-

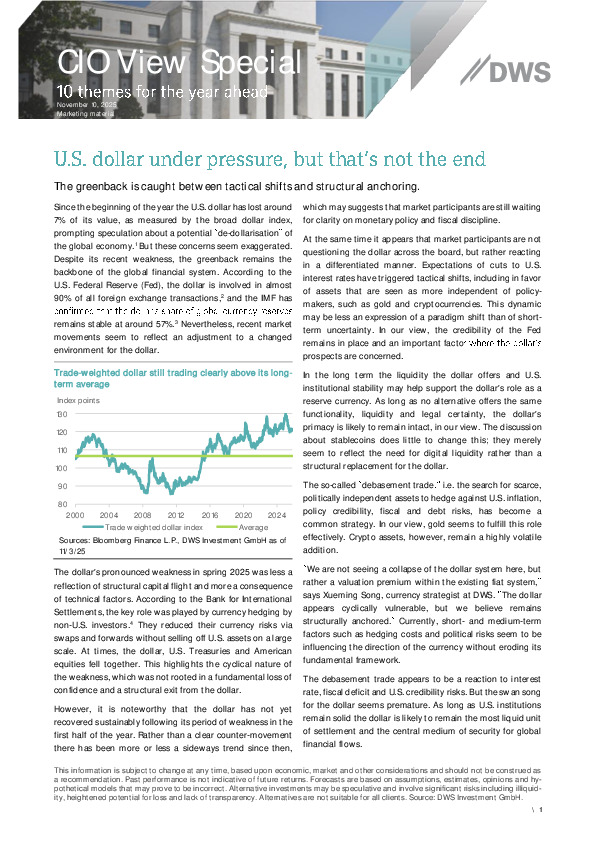

Cyclical Pressure: FX hedging by foreign investors—not capital flight—drove 2025’s dollar slump, while rate-cut expectations keep short-term sentiment cautious.

-

Shift to “Debasement Trades”: Gold and crypto have benefitted from uncertainty, but these flows signal risk-hedging, not a systemic shift away from the dollar.

-

Structural Anchors Hold: The dollar’s unmatched liquidity, legal certainty, and institutional stability continue to underpin its reserve-currency dominance.

Dive into the full report to explore the tactical drivers, long-term fundamentals, and what they mean for currency strategy.

Registreer of log in om verder te lezen. Investment Officer is een onafhankelijk journalistiek platform voor professionals werkzaam in de Belgische beleggingsindustrie.

Een abonnement is GRATIS voor professionals die werkzaam zijn bij banken en onafhankelijke vermogensbeheerders.